SPOTLIGHT

Voices of the industry

Despite technology evolution, there are still pain points in treasury.

“The management of the risk of fluctuating commodity prices should be integrated into the broader framework of treasury management, as its volatility, hedging methods and financial or accounting approach and patterns are intimately linked. In our opinion, it is a mistake to manage these two essential risks separately (especially since the start of the war in Ukraine and the COVID crisis)”. Marco Pescarolo, Ferrero

Automation to prevent risks

“Even though a commodity specialist may not be a treasurer, treasury department is best placed to oversee the management of this particular risk, which has become crucial to remain competitive and profitable due to the volatility of the environment”. Fabrizio Dicembre, Finegan

Digital powers of signature to gain time

“Commodity risk management is far from simple. Entrusting it to specialists seems sound. However, who better than a treasurer equipped with the right tools to manage this type of risk? And if there are no dedicated tool, time to consider new emerging solutions”. François Masquelier, EACT François Masquelier – Chairman of Luxembourg Treasury Association, ATEL and Vice-Chairman of EACT

” Maintaining banking relationships requires the exchange of documents”

INTRODUCTION

Market risk, one of the most important for treasurers. Commodity price risk is consistently a top concern for treasury and risk management officers (ac-cording to last year’s European surveys – see EACT annual survey or PwC global survey). We always think about FX when we see “market risks”. However, it covers many other risks as Interest Rates and Commodities. But, as treasurers are al-ready managing FX and interest rate risk, arguments can be made for adding commodity price exposure to the fold. It is even more accurate when IT applications now enable to manage both in a same solution. We can notice that eventually, treasury is increasingly becoming more involved or even responsible for managing commodity exposures. Treasurers are well fit for commodity hedging programs. Nevertheless, treasury risk managers who have not previously handled commodity hedging will need to be educated or to get knowledges and basis on certain areas. A treasurer needs to understand perfectly which commodity derivative will best match the underlying risk being hedged. Treasurers also must be equipped in tools to (fair) value the hedging instruments and register underly-ing risks to apply hedge accounting. Furthermore, it is important to fully understand the different reference prices for commodities and why prices vary. With commodities, we must nonetheless keep in mind the storage and transportation is-sues, which can or is physical. It is rather different and more complicate compared to electronically managed OTC derivatives. This part of commodity management must be handled by logistic and operations (when the delivery is included into the product – which is not always the case). Another important problem is the potential absence of financial hedging instruments and indices for the commodity risk you want to hedge. Therefore, treasurers must find the closest commodity and best correlated to the commodity risk they want to protect (e.g., Brent for jet fuel or, price of natural gas to be used in a product in Chicago is likely to be based on the NGI Chicago Citygate natural gas price rather than the NYMEX Henry Hub price). Although sometimes the hedging instrument is not perfectly correlated, it should be partly correlated to mitigate risks. And while both price indices which normally closely correlate over time, a local disruption in one market can always arise in a large spike in price with very little movement in the other market. This is a major difference as locational variances are not observed in currency prices.

FOCUS

Identifying financial Risks

Geopolitical, economic, health and demographic events have a direct impact on financial markets, and consequently on SME’s. The international financial environment is subject to strong variations on the foreign exchange and commodities markets. It is difficult for companies to anticipate these erratic movements which directly impact their sales, purchases and therefore their gross margins, whilst these margins are under high pressure given a fierce competition. Experience shows that major currencies fluctuate up or down by about 10% per year. While we see even greater volatility in commodity prices, their volatility averages around 30% over a 90-day horizon. For example, Brent crude oil can vary by 300% in 1 year, Nickel varied in recent past by 60% in 6 months, CO2 is also fluctuating over time up to 70% + and we could continue a long list of volatile underlying assets. It is therefore important to identify the financial risks that can strongly influence the company’s results. We should not underestimate the correlation between currency risks and commodity risks. They are intimately linked. For example, oil is linked to the US dollar (USD), iron ore to the Australian dollar (AUD), gold to the Indian rupee (INR), agricultural raw materials to the Canadian dollar (CAD), etc… Correlation is a fact treasurers or CFOs must contemplate and analyze. The currency and/or commodity risks are important because of their magnitude and high probability of occurrence. These risks affect the value and profitability of companies, whether they are financial, industrial, or commercial.

Knowing your posure (KYE)

Identifying risks is an essential, but not sufficient, prerequisite for any risk management. There a 4 main sources of financial risks we can distinguish :(1). Those arising from industrial and commercial operations, commonly known as industrial and commercial risks; (2) those directly linked to the functioning of financial markets and their operations; (3) those inherent to operational techniques and operators; and (4) those attributable to the management mode. The last thing to tolerate would be to loe money due to financial market fluctuations, without reacting. to the Canadian Dollar (CAD), etc… Correlation is a fact treasurers or CFOs must contemplate and analyze. The currency and/or commodity risks are important. because of heir magnitude and high probability of companies, whether they are financial industrial, or commercial.

How to approach hedging of FX Risk ?

An economic approach, hedging operations (forward transactions, vanilla options) aim to protect the company against random market fluctuations that could penalize its results or reduce the value of its assets. It allows to compensate or reduce potential losses that the company could suffer on the spot market, on the day of the purchase or sale of its real asset. In this approach, the objective is to protect the asset from possible exchange rate fluctuations. The company does not seek to make a gain but to protect its margin. It is the main objective of any treasurer. When the hedging transaction is settled, the company will pay or receive the price guaranteed by the hedging instrument. If market conditions are unfavorable at the time of settlement, the company will be satisfied with its hedge. On the other hand, if market conditions are favorable, the company will have missed out on a profit (i.e., opportunity gain). But and it is essential, no one could have known or guessed the price levels at the outset. The company wants always to cover its operating margin.to the management mode. The last thing to tolerate would be to lose money due to financial market fluctuations, without reacting. to the Canadian dollar (CAD), etc… Correlation is a fact treasurers or CFOs must contemplate and analyze. The currency and/or commodity risks are important because of their magnitude and high probability of occurrence. These risks affect the value and profitability of companies, whether they are financial, industrial, or commercial?

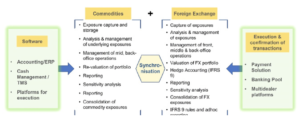

Commodity (and related FX transactions Management

Evolving and effective methodology

Why setting up a dynamic hedging strategy? What are the objectives pursued? There are multiple and complementary. The company may try to cover the totality of the position to be managed, to systematically protect the target price, the reference price, the worst-case price, or its budget price. It may try to keep enough flexibility to take advantage of favorable evolutions or to absorb the risks on the amounts to be managed. Under these conditions, building a strategy within the framework of dynamic management means combining different available hedging instruments to meet the criteria mentioned above. The choice of the instruments and their respective weight in the strategy will condition the quality and the efficiency of this necessary dynamic management.

Therefore, how can one achieve this ?

The simplest strategy involves combining forward operations with what could be called “stop-loss” levels. These are predetermined parity levels that, when reached, should trigger forward operations. Let’s consider, for example, the following strategy: 30% of the position to be hedged is sold forward at market conditions, which is 1.20 EUR/USD; 70% of the position is kept open but protected by the following stop-loss levels; 20% to be sold forward if the exchange rate reaches 1.18 EUR/USD; 25% to be sold forward if the exchange rate reaches 1.16 EUR/USD.

How to assess Commodity Risks the best ?

- Identification of commodity contracts with direct and correlated risks (close link with procurement / purchase department / operations) and interface with the Commodity Hedging Management tool (i.e., CHM).

- Quantification of expected commodity purchase volumes.

- Simulation of volatility of commodity pricing.

- Calculation of projected commodity exposure.

- Definition of strategies to manage or mitigate the exposure (based on internal policies and risk appetite – which must be aligned to FX policy).

- Integration of contracts with collective commodity exposure.

- Assessment of the aggregate impact.

- With a proper assessment, you can enter in ad hoc hedging instrument strategies.

Interview

Olivier Lechevalier

CEO of DeftHedge

“Market risk is one of the most important for treasurers. Commodity price risk is consistently a top concern for treasury and risk management officers, according to last year’s European survey” says Olivier Lechevalier, CEO of Defthedge.

WHAT SMES NEED?

- Pieces of information about markets and economic overviews

- Revaluation tools (upon demand).

- Data storage of commodity hedging instruments, and related FX hedges.

- Technical and financial support when they don’t have dedicated treasurer.

- Ad hoc financial and accounting reporting.

- Interfacing of the commodity risk solution to the ERP and other IT solutions.

- A global better understanding and monitoring of commodity risks.

Firstly, now that we have identified the risks, are there any SaaS solutions that could simplify the lives of treasurers or, even better, finance directors of SMEs without a dedicated treasurer? Are there not enough FX/Commodity solutions for everyone? There are numerous solutions for managing financial risks, including foreign exchange risks. They vary in cost, ease of deployment, and user-friendliness for businesses. Currently, only DeftHedge is as easy to implement as Excel and at a reasonable price. As for managing commodity-related risks, it is a more challenging risk to track, control, and manage on a daily basis. That’s why we have created this innovative solution, to democratize risk management and make it available to finance directors, treasurers, and buyers in a collaborative tool.

But beyond a tool for managing foreign exchange and commodities, aren’t finance directors looking for a decision support tool, which is often lacking? Indeed, financial managers are in search of tools to manage financial risks. Generally, they lack the ability to assess simple or complex hedging instruments in real-time or based on closing rates, to display the relationship between orders, invoices, and payments, to match these elements with hedging, and to generate clear reports for various functions within the company dedicated to accounting, consolidation, treasury, and general management. Finally, there is typically a lack of true experts in financial risk to support clients in implementing the tool. We offer a solution to these initial gaps.

We have often seen finance directors of medium-sized companies managing their commodity-related risks using spreadsheets. Is this still acceptable? What would be the risks of managing these risks in Excel? It is surprising to see companies tracking their risks in an Excel spreadsheet. We regularly see Excel spreadsheets managing risks worth nearly a billion dollars. Data entry and copying errors are common. The main risks include:

- Calculation errors: there is always an error within a sheet on a calculation or formula, and few people reread or check their formulas regularly, as well as the data used.

- Impossible to share the file within the team, Excel is a complex one-person tool. It’s usually an internal, unsecured creation containing sensitive data.

- In general, an average of 3 tables needs to be created to make a decision, and it is generally difficult to reproduce them identically, which can raise questions of reliability.

“It’s amazing to see companies tracking their risks in an Excel spreadsheet. We regularly see Excel spreadsheets managing close to a billion dollars worth of risks.”

- Manual adjustments before a meeting or board of directors are frequent, resulting in inevitably biased information.

- It is challenging to maintain these spreadsheets after a manager’s departure, a change in position, or a change in role.

Do you also believe that revaluation, accounting and financial reporting, as well as dashboards, are elements that finance directors are missing?

Indeed, it is important to have a dashboard, a cockpit, to navigate one’s risk and make informed decisions regarding financial risks. Naturally, the needs will vary depending on the size of the company’s structure. For example, risk managers, finance directors, or treasurers will have a particular appetite for controls, performance measurement, the calculation of accounting exchange rate differences, and the alignment between hedges and underlying assets. Lastly, it is necessary for groups to monitor the valuation of both simple and extremely complex hedging instruments.

Do you think it’s reasonable to separately manage foreign exchange risk and commodity risk?

That’s a great question that often sparks debate! Firstly, it’s important to understand (in general) that currencies are managed by the finance team, while commodities are managed by the procurement team. I’ve often noticed that these two teams struggle to collaborate within the same company on a daily basis. This makes it more challenging to manage and control these risks. It is both reasonable and highly recommended to manage these two risks together. The value of commodities is often inversely related to the value of the currency they are quoted in. For example, if commodities are quoted in dollars, when the value of the dollar rises against other currencies, commodities become more expensive for international buyers, which can reduce demand and, consequently, lower commodity prices. Conversely, if the value of the dollar falls, commodities can become cheaper for international buyers, increasing demand and potentially raising commodity prices. However, it’s important to note that while this inverse relationship often exists, it’s not always present and can be influenced by a multitude of other economic and market factors. Therefore, it’s evident that these two risks should be managed together to control and safeguard a company’s management performance, sales, and margins. The good news is that there are solutions available, and we can assist you.

Take Away

- No one can deny that we are living through turbulent economic times, which are increasingly complex and volatile. In this context, we must pay special attention to commodity risk, whatever it may be.

- Commodity management is inseparable from the management of the related currency risk. Managing one separately from the other would be an additional risk, which is not necessary in these times.

- To have an efficient, centralized, and dynamic management, a specific solution is required, which treasury management systems only partially cover or not at all. But there are such solutions that can be added to other existing solutions and interfaced through api’s.

- Making a good decision is one thing, but executing it well is another. If you have opted for a decision support tool, an execution support tool (e.g., kantox, or other) can be considered to achieve optimal management.

- Data should be consolidated in a single tool, with easy and quick data retrieval capability, to produce ad hoc reports and dashboards.

- Managing raw materials can be complicated. A simple spreadsheet is not a robust or advisable solution.

- You need to consider an absorption cushion to manage the vagaries of production and sales management. Managing raw material inventories is a tricky business. One must be careful not to be over-covered in a world where anything can happen quickly.

- It is not up to the treasurer to decide the amount, but to make sure that it is well hedged and that operating margins are preserved.

- Automating the management of raw materials will free up useful time for more analysis and anticipation, so cruelly needed in times of crisis. It is also necessary to be able to “benchmark” one’s management against a predetermined reference.

- It is a continuous management, an on-going and dynamic process that requires competence, appropriate tools, and know-how. We must constantly adapt to the market’s changes.

Conclusion

“Despite treasury management system technological evolution over last years, there are still pain points in the market and commodity risks management treasurers must address” (françois masquelier, chairman of eact)

Commodity management is a complicated mission. It is a double management (i.e., commodity + FX risk versus USD) that makes it even more delicate. Managing one without the other seems to be a bad idea. But managing without an adapted and “best-in-class” IT tool seems risky. It is even less advisable as there are cheap and efficient solutions, with an easy and quick implementation. Why deprive yourself of being efficient? The spreadsheet, the preferred tool of commodity managers, should be banished as it carries the risk of manipulation and calculation errors. Robust, reliable, and complete tools are needed to capture all operations to re-evaluate them and manage them financially and accountably. In a context of hyper-volatility, more than ever, the company must hedge but also to manage properly and efficiently its raw material risk and the related USD risk. Fortunately, this challenge is easy to meet if you know how to find the right tool.